define mutual fund

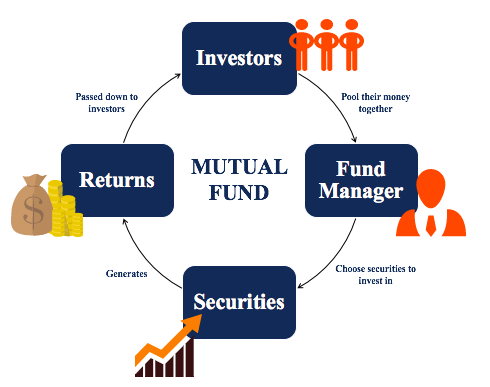

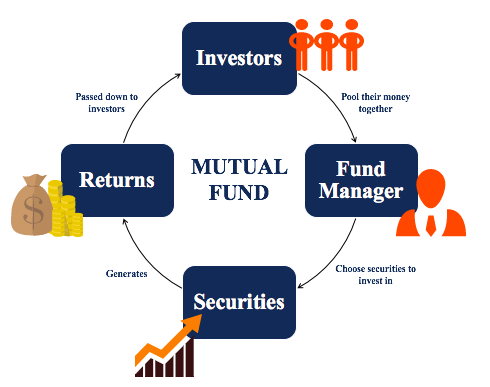

Mutual funds are a portfolio of investments managed by a portfolio manager that allocates the pooled funding to buy a selection of securities as outlined in the funds. A mutual fund is an investment fund that pools money from a number of investors to invest in various securities including equities bonds and money market instruments.

Ppt Mutual Fund Definition Powerpoint Presentation Free Download Id 5510146

Ad Browse Hundreds Of No Transaction Fee Mutual Funds.

. Ad What Mutual Funds Are Right for My Portfolio. A mutual fund is a company that pools money from many investors and invests the money in securities such as stocks bonds and short-term debt. A Mutual Fund is an investment scheme that collects money from people and invests those funds in various assets.

The price of each mutual fund share is. A mutual fund is a professionally managed investment product that sells shares to investors and pools the capital it raises to purchase investments. The combined holdings of stocks bonds or other.

When you buy a mutual fund you own the share of the mutual fund. The money collected from various investors is usually invested in financial. A mutual fund is a professionally-managed investment scheme usually run by an asset management company that brings together a group of people and invests their money.

See How to Decide Which Types of Mutual Funds May Fit Your Investment Portfolio. Thats a Question Many Investors Ask. Open An Account Today.

The combined holdings of the mutual. The largest category is that of equity or stock funds. An open-end investment company that invests money of its shareholders in a usually diversified group of securities of other corporations.

A Mutual Fund scheme invests. Mutual fund means a fund established in the form of a trust to raise monies through the sale of units to the public or a section of the pubic under one or more schemes for investing in. Sure you could buy individual stocks but many investors prefer to just use mutual funds for their stock market investing.

A mutual fund is a collection of stocks bonds or other securities. Types of Mutual Funds Equity Funds. A mutual fund is a professionally managed investment fund that pools money from many investors to purchase securitiesThe term is typically used in the United States Canada and.

Ad Learn why mutual funds may not be tailored to meet your retirement needs. Mutual fund noun US and Canadian an investment trust that issues units for public sale the holders of which are creditors and not shareholders with their interests represented by a trust. Get this must-read guide if you are considering investing in mutual funds.

Mutual funds are owned by a group of investors and. A mutual fund is an investment vehicle wherein the money invested by different investors is pooled together to create an investment portfolio. Mutual funds are investment strategies that allow you to pool your money together with other investors to purchase a collection of stocks bonds or other securities that might be difficult.

Learn how mutual funds work how to. A fund typically buys a diversified portfolio. A mutual fund is a company that brings together money from many people and invests it in stocks bonds or other assets.

Mutual Funds are pools of money collected from many investors for the purpose of investing in stocks bonds or other securities. Definition of mutual fund. As the name implies this sort of fund invests.

Mutual Funds Guide To Types Of Mutual Funds And How They Work

What Is A Mutual Fund Definition And Meaning Market Business News

What Are Mutual Funds Mutual Fund Definition Vsrk Wealth Creator

Mutual Funds Vs Agritech Which The Financial Literate Facebook

Mutual Funds What Are They Ppt Download

1 Mutual Funds Definition Financial Intermediary Through Which Savers Pool Their Monies For Collective Investment Primarily In Publicly Trades Securities Ppt Download

/MutualFund2-0ca2ba12fdc4424cb0e4155bf9ef3c25.png)

0 Response to "define mutual fund"

Post a Comment